Top 5 Ways Generative AI Boosts Accessibility and Usability of Automated Customer Support

Conversational AI in Banking: 2024 Use Cases & Success Stories

- Conversational AI vs. Generative AI: What’s the Difference?

- Benefits of Conversational AI in Banking

- Case Studies

- Conversational AI Use Cases

- Zendesk Offerings

During its 2023 Investor Day, JPMorgan Chase, the most heavily capitalized bank on the globe, revealed that Artificial Intelligence helped it bring in more than US$0.5 billion in value via personalization. One branch of the technology that is particularly known for its rich personalization capabilities is called conversational AI.

In this article, we examine conversational AI in banking through practical examples, providing you, the reader, with the latest real-world evidence on its impact.

Conversational AI vs. Generative AI: What’s the Difference?

Let us break down the concept of conversational AI. First things first, you should not mistake it for generative AI, or GenAI for short. While sharing a number of commonalities and sometimes being used interchangeably, these two sub-technologies serve different purposes. Unlike GenAI, conversational AI is focused exclusively on simulating discussions as if they were led by a human being. In order to achieve that, it relies on distinct foundation models and a mix of machine learning (ML), natural language processing (NLP), text-to-speech, and speech-to-text functionalities. In the meantime, the goal of generative AI is to produce content such as text, images, or code based on learnings acquired from user input and other training sources.

Now then, if they can’t be used interchangeably, can they co-exist? The answer is absolutely! For example, as part of its conversational AI packages, Google Cloud includes GenAI agents fueling all text and voice dialogs. At this point, you might be wondering, but has there been conversational AI in banking before? That’s right. But it was deterministic, not generative by nature. For more information on its evolution, see the comparison table below.

| Deterministic AI Agents | Generative AI Agents |

| Think of them like chatbots with a script. | More like chatty companions. |

| Rely on pre-defined rules and responses based on keywords or “intents” you identify. | Use large language models (LLMs) to understand and respond to natural language, similar to how humans communicate. |

| Great for handling FAQs and tasks with clear-cut answers. | Can answer open-ended questions, engage in conversation, and even generate creative text formats. |

| If the user asks something unexpected, they might get confused. | The responses are based on probabilities. |

Benefits of Conversational AI in Banking

It goes without saying that conversational AI in banking has plenty to offer — otherwise, it wouldn’t be implemented by so many institutions worldwide.

- It improves operational efficiency and saves costs. As it deflects a significant portion of customer inquiries, conversational AI can significantly reduce the workload on call centers, which translates to lower staffing needs, infrastructure expenses, and training costs.

- It’s one-to-many scalable. Conversational AI agents can handle numerous conversations with different users at the same time. Unlike human customer service representatives, they don’t get overwhelmed by high volumes.

- It’s available round the clock. AI agents can be deployed 24/7/365, assisting your clients consistently no matter the time zone or holiday season, which is particularly useful for global businesses.

- It keeps users engaged and their experiences personalized. Conversational AI can learn and adapt to individual user preferences. Analyzing past interactions and user data (with proper consent, of course), the AI can tailor its responses, recommendations, or actions to better suit each user’s needs.

Beware, however, that there are several pitfalls as well.

- It may not be as empathetic as people. Even AI systems that show a certain level of empathy rely on pre-programmed responses or prompts, which can come off as generic or inauthentic compared to the genuine empathy humans can offer.

- It may not be trained to resolve edge cases. Conversational AI is trained on massive datasets, but there will always be scenarios it hasn’t encountered yet. Moreover, the core function of most conversational AI is to provide accurate information or complete tasks, so when faced with an edge case, the AI might prioritize maintaining accuracy over offering a creative solution.

Nonetheless, the AI space is progressing at a lightning pace and enjoys fierce competition along with generous R&D budgets, meaning there’s a high chance these obstacles will eventually be dealt with.

Case Studies

Here, we look at players who have already adopted conversational AI in banking and yielded tangible results.

EVO Banco

EVO Banco is one of the largest digital-first banks in Spain, so it’s only logical that it has forayed into the AI space as well.

The cornerstone of its system lies in Google Cloud’s Speech-to-Text API. The tool functions as the initial data capture mechanism, transcribing audio from customer calls into a readily usable text format. The real-time transcription eliminates processing delays, ensuring immediate analysis of customer inquiries.

Once the conversation is converted into text, Dialogflow takes center stage. This advanced natural language processing platform acts as the system’s analytical engine, identifying the intent behind each interaction. Is the customer seeking information, requesting a specific action, or encountering a complex issue requiring human intervention? Dialogflow’s algorithms effectively categorize these inquiries, ensuring appropriate routing.

Based on Dialogflow’s intent classification, the system determines the optimal response strategy. For straightforward questions requiring factual information, the system can deliver an accurate answer directly and immediately. A handover to a human representative is initiated in cases of complex inquiries or situations exceeding the system’s current capabilities.

In turn, Dataflow analyzes all customer interactions, locating patterns and extracting valuable insights from each conversation. Continuous learning allows the system to refine its response strategies over time, progressively improving its ability to accurately parse customer intent and deliver exceptional service.

The results of embracing conversational AI in banking have been nothing short of astonishing for EVO Banco:

- 85% coverage of contact center calls.

- 3% share in the contact center cost structure.

- 95% accuracy in routing.

- 2-minute wait time on average.

Federal Bank

Federal Bank was the first Indian bank to roll out digitalization to all of its physical sites. It has also pioneered Artificial Intelligence-powered personal assistants. Utilizing Google Cloud AI solutions, the company developed Feddy, who’s now ready to come to the rescue of more than 10 million customers in the country.

But Federal Bank didn’t settle for a run-of-the-mill AI solution. Its vision was ambitious: a truly interactive virtual agent capable of learning independently, handling intricate banking transactions, and empowering customers to block payments or even select new debit cards — all through a natural conversation.

The path to achieving this goal, however, was full of challenges. The bank had to assess tens of conversational AI providers, encountering a consistent hurdle in limited query flexibility. These solutions might excel at answering straightforward questions like “What’s my balance?” but fail to parse a slightly different phrasing, such as “How much money do I have?”. Furthermore, the training process for these chatbots proved to be time-consuming. Federal Bank discovered that manually training the bot for each potential question amounted to roughly a thousand questions each month, along with ongoing refinements based on understanding levels.

With Dialogflow, conversational AI in banking acquired the long-sought self-learning ability, which eliminated the need for manual intervention for every single question. The newfound efficiency also allowed Federal Bank to focus on broader strategic goals. Moreover, the integration of Dialogflow and TextMagic has offered a compelling set of advanced conversational AI techniques. These included mirroring, where the bot subtly adapts its communication style to match the customer’s speech patterns.

The results look more than promising:

- 25% increase in customer satisfaction.

- 98% accuracy of responses to customers.

- 133% rise in the number of handled tickets.

- 50% expected reduction in customer care-related expenses.

- 5 hours of developers’ time saved every day.

Conversational AI Use Cases

This section overviews some of the most common use cases of conversational AI in banking.

Opening an Account

The AI can collect basic KYC information like full name, proof of residence, and date of birth. While doing so, it can guide customers through capturing clear photos of their IDs and other documents according to the required format. It can later automatically extract data via Optical Character Recognition (OCR) to reduce manual entry errors and speed up the verification process as a whole.

Moreover, the AI can analyze the collected data against pre-defined risk parameters related to anti-money laundering (AML) and anti-terrorist financing (ATF) policies, flagging potential high-risk cases for further human review by compliance officers.

Providing Financial Advice

Conversational AI for banks can ask clients questions about their financial goals, risk tolerance, and financial situation. Based on this information, AI can provide personalized initial guidance and helpful follow-up resources.

It can be a great educational tool, too. Building upon an area of interest, conversational AI can introduce customers to basic financial literacy concepts, explain financial products and their derivatives, and direct users to qualified human advisors in more nuanced situations.

Savings/Tx Analytics

Conversational AI can help customers track income and expenses, spot areas where they can save, and set up automated budgeting plans to promote financial awareness and responsible money management. AI can also help clients define milestones and track progress over time, keeping them motivated and accountable.

Apart from that, AI can automate repetitive tasks like bill payments or send timely reminders to save or invest. What’s more, AI can analyze spending habits and identify potential financial risks, prompting users to act before they snowball into huge problems.

Identity Safeguards

Conversational AI in finance can guide customers through the MFA process, ensuring they complete all verification steps to confirm their identity before authorizing high-risk transactions. This step involves asking knowledge-based questions, sending one-time codes, or even using biometric verification through voice or image recognition.

In case an incident has already occurred, AI can assist the client with reporting a suspected identity theft attempt any time of day, ensuring faster response times compared to traditional customer care channels with limited hours.

Fraud/Scam Protection

Conversational AI can analyze user interactions in real-time, triggering alerts for suspicious behavior patterns indicating fraudulent activity. Take, for example, deviations from typical spending habits, unusual language patterns, or attempts to access an account from unrecognized devices or locations.

Chatbots can also educate customers on cybersecurity best practices, delivering interactive modules on strong password creation, phishing scams, and social engineering tactics.

For more information on the underlying infrastructure of conversational AI in financial services, check out our article on cloud adoption in financial services.

Zendesk Offerings

Zendesk is listed as the best mid-market help desk software on a popular P2P business & IT review site G2. In terms of AI, Zendesk products offer the following features:

- Automated customer interactions: Free your agents from repetitive tasks by deploying AI-powered agents that can handle routine inquiries efficiently.

- Conversation bots: Leverage chatbots to answer frequently asked questions 24/7 and guide users through common tasks, making them wait less and be more satisfied.

- Auto-replies with articles: Deliver instant support with pre-written responses that automatically link to relevant knowledge base articles, providing users with the information they need quickly.

- Generative replies: Go beyond static pre-programmed answers. Zendesk AI can generate dynamic responses tailored to the user’s specific intent, ensuring a more natural and helpful conversation flow.

- Bot personas: Chatbots in banking can benefit from unique personalities crafted to create a more engaging user experience and build trust with customers interacting with the AI.

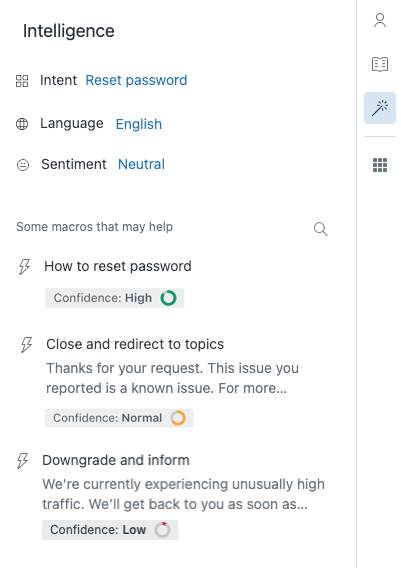

- Suggested intents when creating answers: Let the platform suggest relevant intents during answer creation. This ensures your content is appropriately categorized and routed to the right users.

- Intent suggestions for unanswered questions: Identify knowledge gaps and receive intent suggestions for new content. This proactive approach helps ensure your knowledge base is always up-to-date and addresses user needs effectively.

- Suggested macros for agents: Equip your agents with pre-built macros used for similar tickets in the past, saving them time and effort while ensuring consistency in communication.

- Knowledge in the context panel: Provide agents with easy access to relevant knowledge base articles and community forums directly within the interaction window, allowing them to quickly find the information they need to assist customers effectively.

- Content Cues for content managers: Gain valuable data-driven insights on knowledge base gaps and areas needing improvement. These insights help content managers prioritize content creation.

- Semantic search in the help center: Employ powerful search functionality that understands user intent, allowing users to easily find the most relevant content, even if their search query doesn’t perfectly match existing keywords.

Regardless of the plan you’re currently on, Cloudfresh is a Zendesk Premier Partner that can help you select a suite of features tailored to your unique business scenarios and launch a full-fledged Zendesk implementation project. It all starts with a free consultation on conversational AI in banking — to request one, please fill out the form below.